Recent Insurance Premium Increase Breakdown

Insurance Premium Increase

On April 2nd 2015 CMHC announced that effective June 1, 2015, the mortgage loan insurance premiums for homebuyers with less than a 10% down payment will increase by approximately 15%.

Canadian financial expert Preet Banerjee recorded a short 2 minute video that summarizes how the increase could impact you. Watch the video and follow along with the transcript if you like. From there, let’s discuss how breaking down the increase to a simple monthly payment doesn’t account for the true cost of the increase.

Transcript

How might the recently announced increase to CMHC premiums affect you? If you’re buying a home with less than 10% down, you might be paying more for your mortgage loan insurance as of June 1st 2015. CMHC insurance is mortgage default insurance that many homebuyers require in order to get a mortgage from lenders.

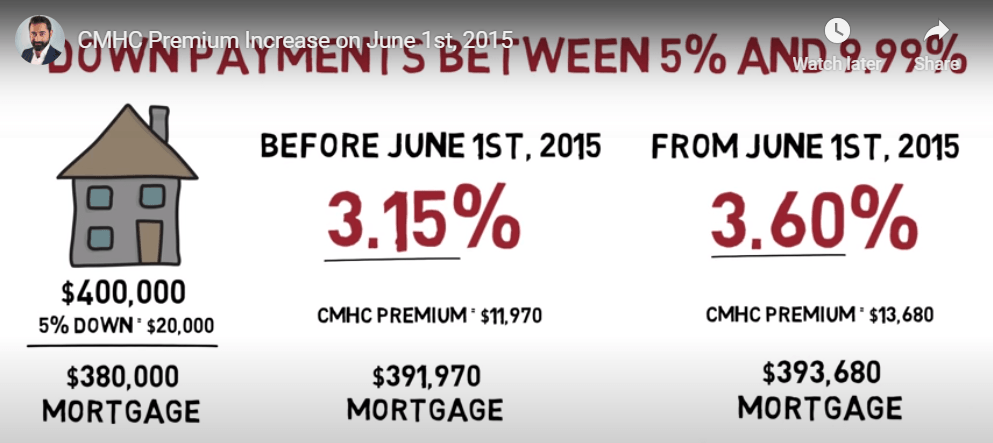

The premium for this insurance usually gets added to your mortgage balance. For down payments between 5% and 9.99% the premium up until June 1st 2015 is 3.15%, but on June 1st 2015 the premium increases to 3.60%.

To see how this change might affect your bottom line let’s look at an example:

Suppose you want to buy a $400k home, a 5% down payment would be $20k. That means you would initially be looking at a $380k mortgage. The old premium 3.15% equals $11,97o which would increase your initial mortgage balance to $391,970. The new premium of 3.6% equals $13,680, which would increase your initial mortgage balance to $393,680. That’s a difference of $1710. Assuming a 2.5% 5 yr fixed rate mortgage with an amortization of 25 years, that means that under the old premium your mortgage payments would initially be $1,755.89. With the increased premium your mortgage payments would initially be $1763.55.

That works out to an increase of $7.66 per month.

So is CMHC selling me a used car?

When CMHC initially made the announcement, they included the following in their release: “For the average Canadian homebuyer who has less than a 10% down payment, the higher premium will result in an increase of approximately $5 to their monthly mortgage payment. This is not expected to have a material impact on housing markets.”

It kinda sounds like CMHC is framing this increase as one that won’t have an impact to the average Canadian home buyer. Isn’t this a lot like a low-brow used car sales tactic of trying to sell a car without acknowledging the price or interest rate but rather simply focusing on the affordability of the monthly payments?

Let’s use Preet’s example. Although $7.66 a month increase in a mortgage payment doesn’t sound like a huge deal… there are some flaws in the assumptions. To break down the increase into a monthly cost in order to minimize it’s impact makes the assumption that you are going to take the full payment schedule to payoff your mortgage. That is 25 years. What is the likely hood that you are now purchasing the home you are going to be living in for the next 25 years? As most Canadians either move or change their mortgage financing every 3 years… not likely.

If you go back to the transcript or watch the video, you will see that:

The actual increase in premium isn’t just $7.66 a month, it’s the total of $1710.

This is because the $1710 is capitalized into your mortgage, or added to your mortgage balance… so when you pay out your mortgage you will be paying the FULL amount at that time. There is no escaping it. Regardless of how you break it down, if you refinance your mortgage or if you sell your property and buy a new place, you will eventually pay the full $1710. So to present the increase as insignificant seems rather insincere.

Keep in mind that in this example the actual overall cost of insurance is actually $13,680 not just the increase of $1710.

Takeaway

Although it’s true, the immediate impact of the increase might only be a few dollars added to your monthly payment, if you are purchasing a property with 5% down, you should be aware of the greater impact the entire insurance premium can have on you down the road.

After you apply your downpayment of 5%, and add back the insurance premium of 3.6%, you actually only have 1.4% equity left in your property. If you are looking to sell your place in the short term, with typical real estate commissions at 5%, you would already be 3.6% underwater from day 1 which could significantly limit your options.

When buying a property with 5% down, it is imperative that you have a plan in place and that you understand how the decisions you make today can impact your future. I would love to help you work on a plan.

Katherine Martin

Origin Mortgages

Phone: 1-604-454-0843

Email: kmartin@planmymortgage.ca

Fax: 1-604-454-0842

RECENT POSTS